We have more than 20 years of experience

Abou us

Empowering Your Path to Homeownership

Streamlining the path to homeownership with personalized solutions, competitive rates, and unwavering support. Your journey, our mission.

Unlock the door to your dream home with us—where every step forward is a step closer to where you belong.

- Fast & Easy Process

- No prepayment penalty

Empowering Your Journey Home

Where Dreams Meet Opportunity

Pave the way to your dream home with us—where each step is a journey filled with promise and potential. Together, let’s turn your vision into reality!

Call Now

321.947.0339.

services

Your Future, Our Focus

Conventional Loans

Unlock Your Home Dreams with Conventional Wisdom: Simplified Financing for Your Future!

FHA

Loans

Unlock the Door to Your New Home with FHA Loans – Making Homeownership Possible for Everyone.

VA

Loans

Salute Your Service with Exclusive VA Loans: Zero Down, Hero-Worthy Homeownership!

USDA

Loans

Plant Your Roots with USDA Loans: Cultivate Your Homeownership Dreams in Rural America!

We Have Around 2k+ Employs

have any question ?

Call Anytime

321-947-0339

why choose us ?

Where Your Homeownership Dreams Come Alive

At Samantha Home Loan Financing, innovation meets dedication. With a wide range of loans, cutting-edge technology, and a commitment to personalized service, we make the mortgage process smooth and straightforward. Join the Samantha Home Loan Financing family for a trusted path to your new home.

Homeownership Simplified Here

Turn the key to your dream home with Samantha Home Loan Financing - Guiding you home, every step of the way

3000 professional loan officer we have

more than 307 branches we have

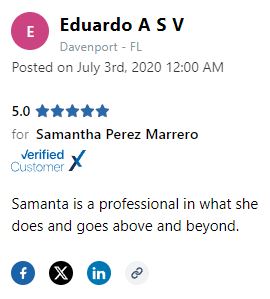

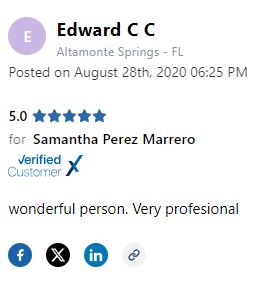

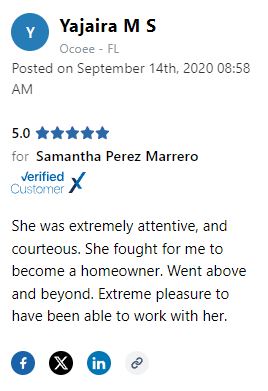

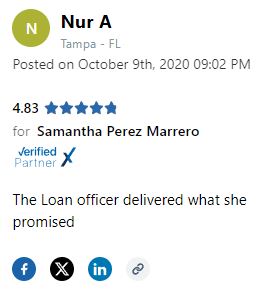

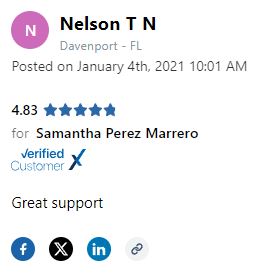

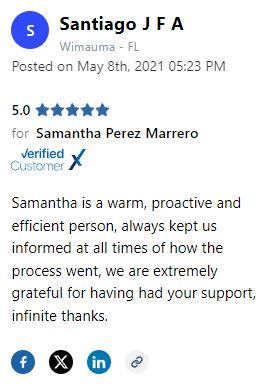

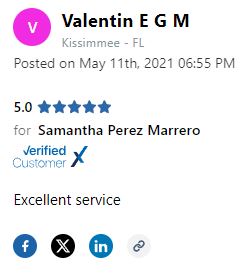

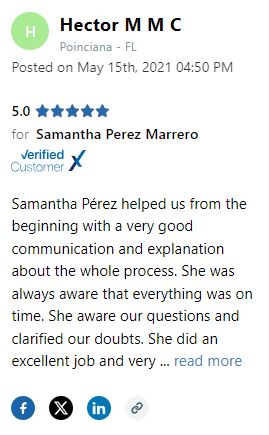

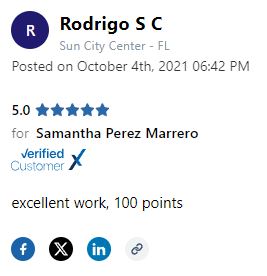

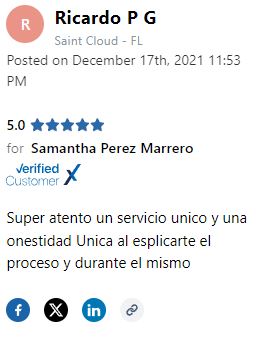

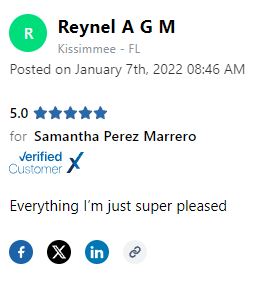

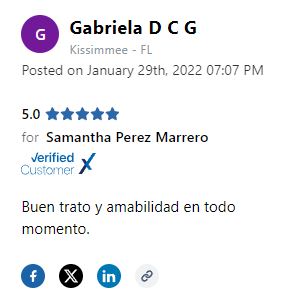

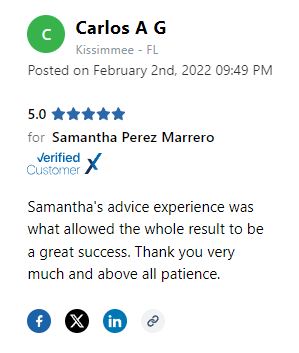

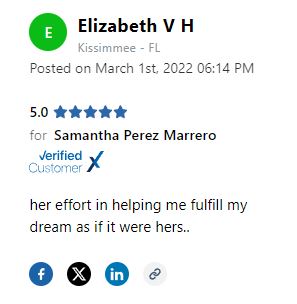

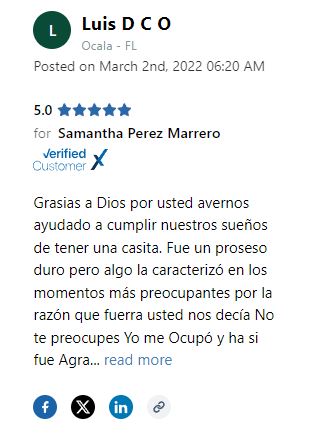

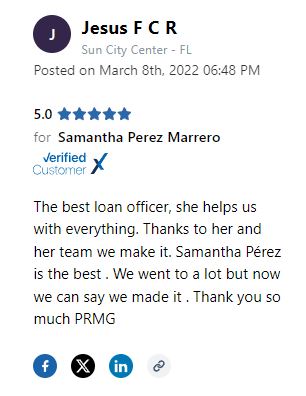

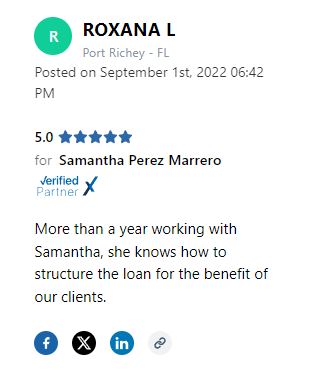

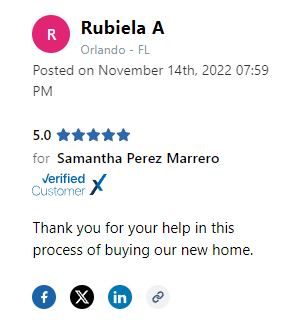

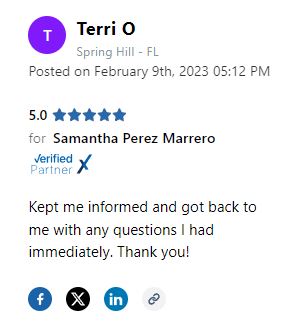

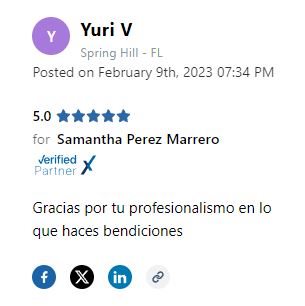

testimonial

what our client say ?

4.75 / 5 - from 55 review

frequently asked question

Receive Responses to Your Queries

Our 'Path to Pivot' approach is designed to pivot traditional mortgage lending into a more consumer-focused experience. This means leveraging modern technology to streamline the application process, offering personalized loan options that meet your unique needs, and ensuring you receive industry-leading customer service every step of the way. It's about making your journey to homeownership smoother and more accessible.

While we embrace technology for efficiency and convenience, we believe in the irreplaceable value of human touch. Our technology is designed to enhance, not replace, the personal interactions with our dedicated loan officers. We ensure that every borrower has a direct line of communication with their loan advisor, providing guidance, clarity, and support throughout the mortgage process.

PRMG Cares is our way of giving back to the communities we serve. Through donations, volunteer work, and supporting local and nationwide charities, we strive to make a positive impact. Our clients can get involved by participating in community events, volunteering for initiatives, or donating directly to causes we support. It's a partnership in philanthropy and community building.

Our extensive network and longstanding industry relationships enable us to offer competitive rates to our clients. We continuously monitor the market to ensure our rates are competitive and offer a variety of loan products to suit different financial situations. Our team works diligently to provide you with options that best fit your financial goals and needs.

Unlike many large lenders, PRMG combines the resources and capabilities of a national lender with the personalized service of a local firm. Our unique culture, built on teamwork, integrity, and commitment to excellence, ensures that we treat every client as part of our family. Our aim is not just to provide a loan but to guide you to the right path towards homeownership with care and expertise.

Our approach to loan application and approval emphasizes simplicity, speed, and clarity. We use state-of-the-art technology to simplify the submission of documents and information. Our loan officers are proactive in communicating with you throughout the process, ensuring you understand each step and what is required. This transparency and efficiency aim to minimize stress and make your experience as positive as possible.

Absolutely. PRMG offers a range of loan products tailored for investment properties and second homes, including specific loan programs designed for these purposes. Our loan advisors can provide expert advice on the best financing options for your investment goals, taking into account market trends, rental income potential, and your financial portfolio.

These FAQs are designed to provide detailed insights into PRMG's services, value