FHA Loans

Home > FHA Loans

Achieve your dream of homeownership with the support of FHA Loans from Samantha Home Loan Financing. Designed for low-to-moderate income borrowers, FHA loans require lower minimum down payments and credit scores than many conventional loans, making them an ideal choice for first-time homebuyers and those with less-than-perfect credit.

benefit of our sevices

- Lower Down Payments: Get into your new home with as little as 3.5% down.

- Easier Qualification: Qualify with lower credit scores and higher debt-to-income ratios compared to conventional loans.

- Flexible Funding: Use gifts or grants for down payments and closing costs.

- Government Assurance: Backed by the Federal Housing Administration, offering lenders security and borrowers peace of mind.

An FHA loan is a mortgage insured by the Federal Housing Administration, designed to help lower-income borrowers afford a home.

Requirements typically include a lower minimum credit score (around 580 for the minimum down payment), a down payment of at least 3.5%, and a reasonable debt-to-income ratio.

FHA loans are eligible for single-family homes, multifamily properties up to four units, and certain condos and manufactured homes, subject to FHA appraisal and guidelines.

Yes, borrowers must pay upfront and annual mortgage insurance premiums, which protect the lender in case of a default.

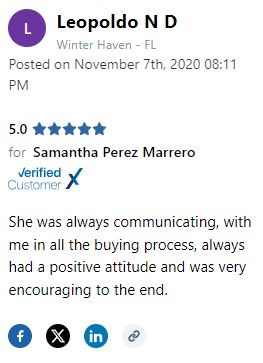

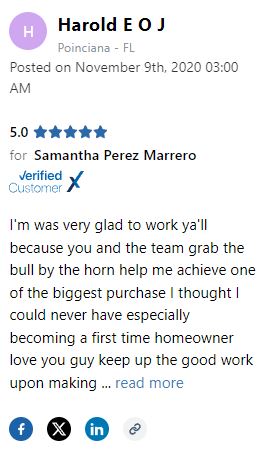

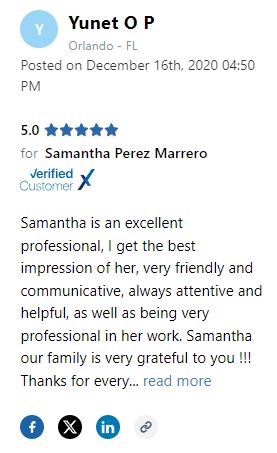

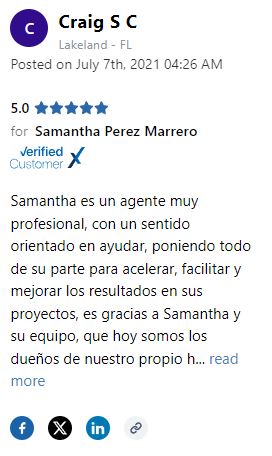

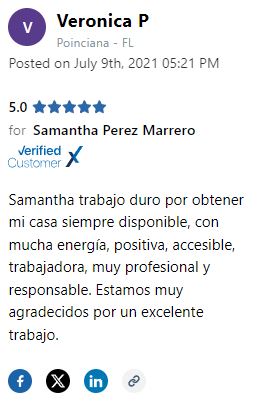

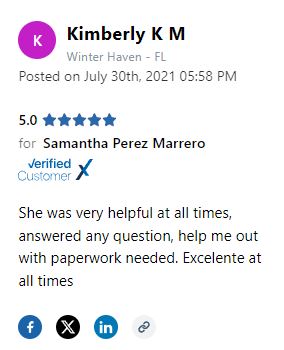

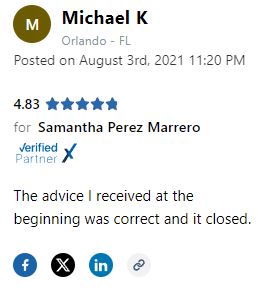

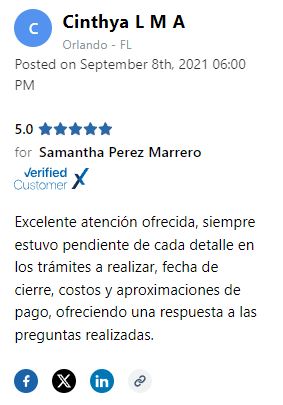

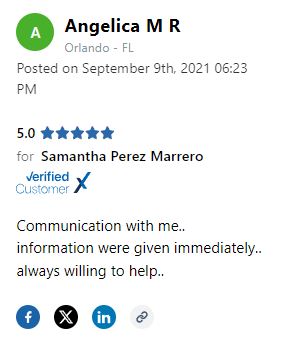

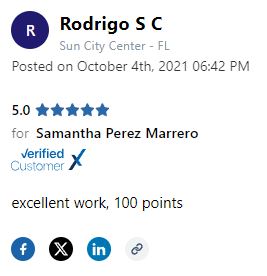

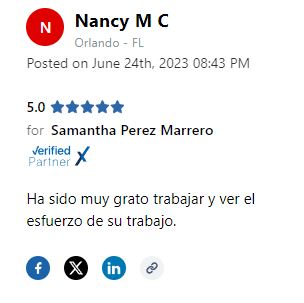

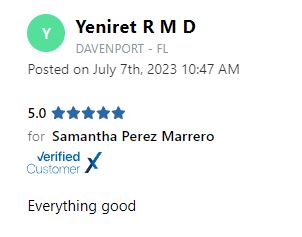

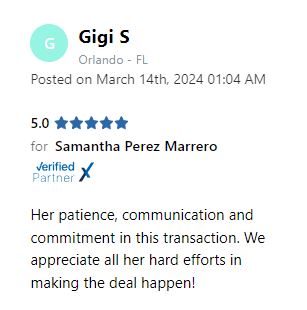

testimonial

what our client say ?

4.75 / 5 - from 55 review