USDA Loans

Home > USDA Loans

Experience the benefits of rural homeownership with the USDA Loan program offered by Samantha Home Loan Financing. Tailored for residents in rural and suburban areas, USDA loans provide an affordable pathway to homeownership with no down payment required, making it easier than ever to purchase your dream home in the countryside.

benefit of our sevices

- No Down Payment Required: Step into your new home with zero down payment, a rare opportunity in today’s market.

- Lower Interest Rates: Enjoy more affordable borrowing costs with interest rates typically lower than conventional loans.

- Flexible Credit Requirements: Qualify with less-than-perfect credit thanks to more flexible guidelines compared to conventional loan options.

- Government-Backed Security: Benefit from the security of a government-backed loan, offering lenders confidence and borrowers peace of mind.

A USDA loan is a government-backed mortgage designed for homebuyers in rural and certain suburban areas, offering benefits like no down payment and reduced mortgage insurance costs.

Qualification is based on the property location, income level (must be within specified limits for the area), and creditworthiness, though requirements are generally more flexible than for conventional loans.

Eligible properties typically include single-family homes that are primary residences located in designated rural and suburban areas as defined by the USDA.

Yes, USDA loans have income limits which vary by region and are designed to assist moderate to low-income families in purchasing homes in rural areas.

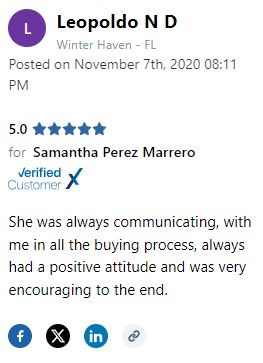

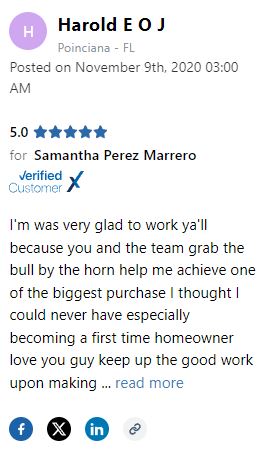

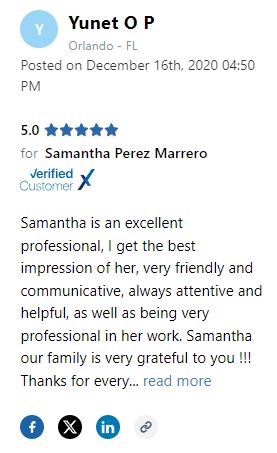

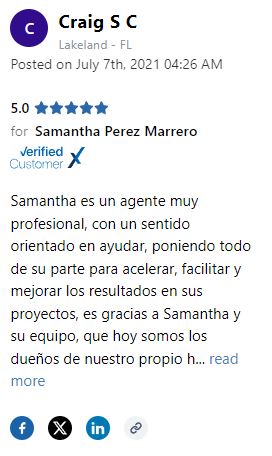

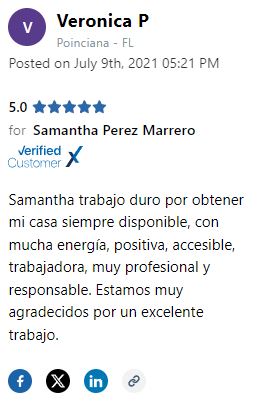

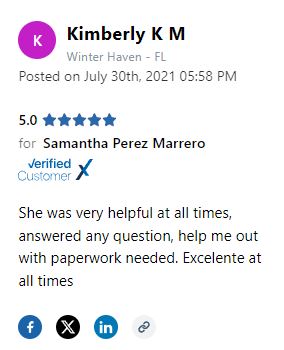

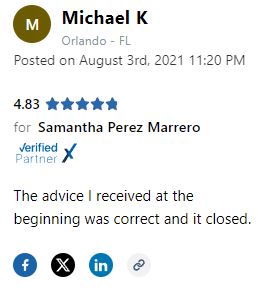

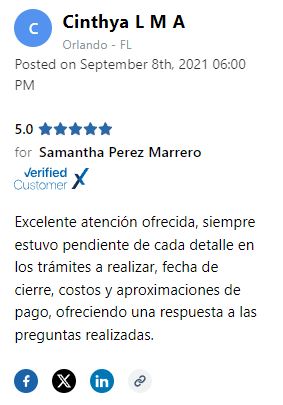

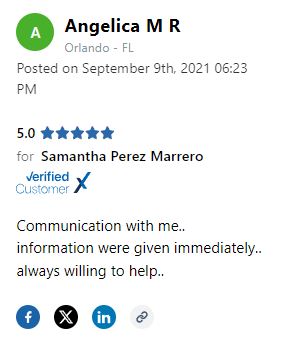

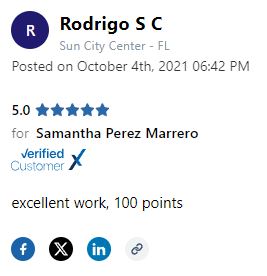

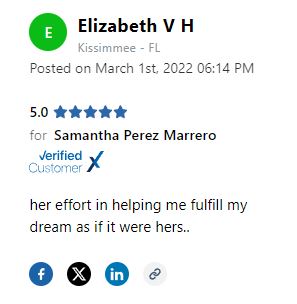

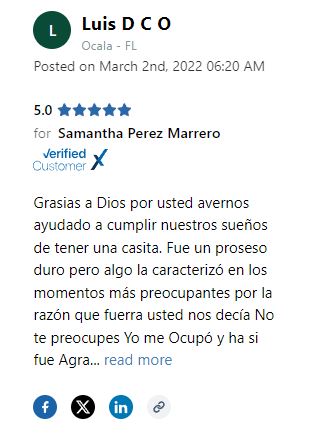

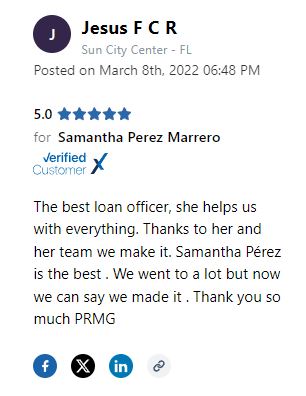

testimonial

what our client say ?

4.75 / 5 - from 55 review