State and Local Programs

Home > State and Local Programs

Tap into a wealth of resources designed to make homeownership more accessible and affordable with our State and Local Programs. Samantha Home Loan Financing partners with various state and local agencies to offer programs that can include down payment assistance, reduced interest rates, and other financial benefits to help you secure your dream home in your community.

benefit of our sevices

- Localized Benefits: Take advantage of programs specifically tailored to the needs and opportunities within your state or locality.

- Financial Support: Access financial aids like grants, subsidies, or forgivable loans to reduce the upfront and ongoing costs of homeownership.

- Reduced Barriers to Entry: Lower the traditional barriers to homeownership, making it easier for first-time buyers and low to moderate-income families to buy a home.

- Community Integration: Encourage community stability and development by helping residents invest in their local areas.

State and local programs are initiatives sponsored by local or state governments designed to assist residents in becoming homeowners through various supports such as down payment assistance and tax incentives.

Eligibility criteria can vary widely depending on the program and location but generally include factors like income level, first-time homebuyer status, and the property being located in a specific area.

Often, yes. Many state and local programs can be used in conjunction with other loan types, such as FHA, VA, or conventional loans, to optimize the financial benefits.

Benefits can include down payment assistance, competitive mortgage rates, tax credits, and other financial aids designed to make homeownership more accessible.

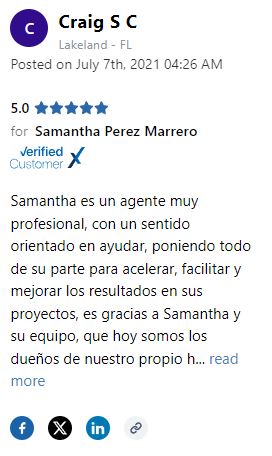

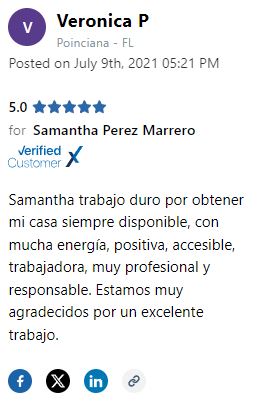

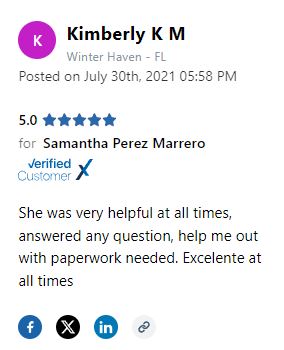

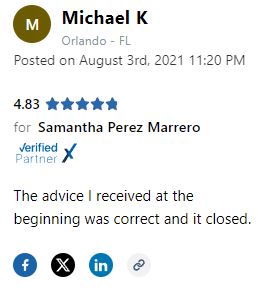

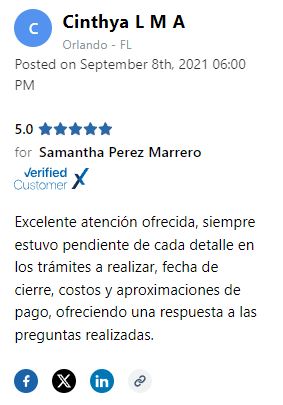

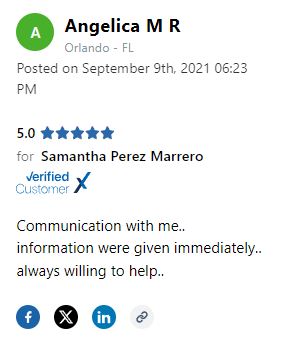

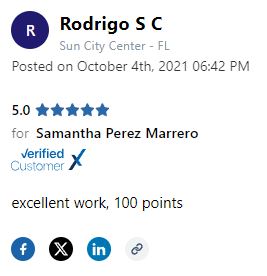

testimonial

what our client say ?

4.75 / 5 - from 55 review