Specialty Programs

Home > Specialty Programs

At Samantha Home Loan Financing, we understand that every borrower’s situation is unique. That’s why we offer a variety of Specialty Programs designed to meet specific needs and circumstances, from zero-down payment options to loans tailored for self-employed individuals. Discover the right financing solution that aligns with your unique path to homeownership.

benefit of our sevices

- Tailored Solutions: Access loan programs specifically designed for unique employment situations, property types, and borrower needs.

- Flexible Qualification Criteria: Benefit from programs that have more accommodating qualification criteria for borrowers who might not fit traditional lending molds.

- Innovative Loan Products: Explore innovative options like interest-only loans, graduated payments, and more.

- Expert Guidance: Receive personalized support and guidance from our expert loan officers who specialize in crafting custom mortgage solutions.

Specialty loan programs are designed to cater to specific borrower needs that are not typically met by standard loan products, such as loans for unique properties or non-traditional income sources.

Borrowers with unique circumstances, such as those who are self-employed, buying unconventional properties, or have fluctuating incomes, may find specialty programs particularly beneficial.

Yes, in many cases, specialty programs can be combined with other loan types to create a financing solution that best fits a borrower’s needs.

Consider factors such as the specific requirements of the program, potential higher costs or fees, and the suitability of the loan type for your long-term financial goals.

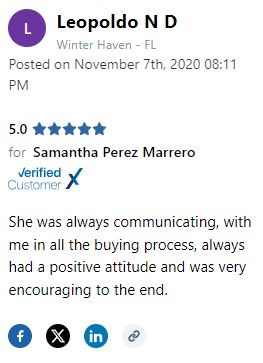

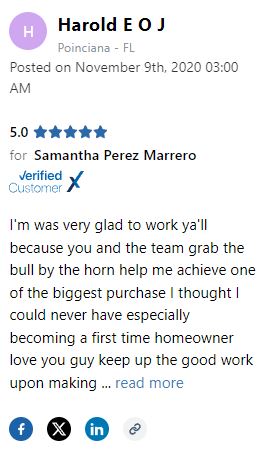

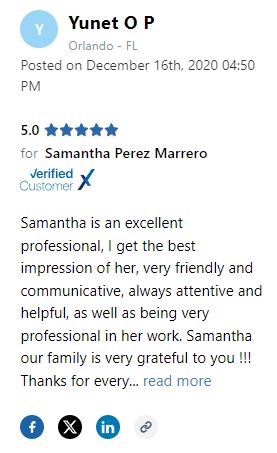

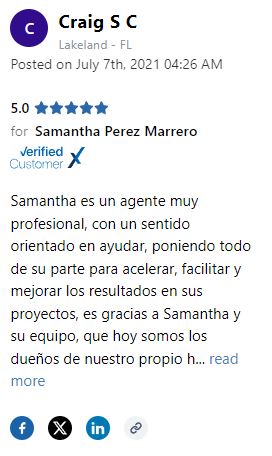

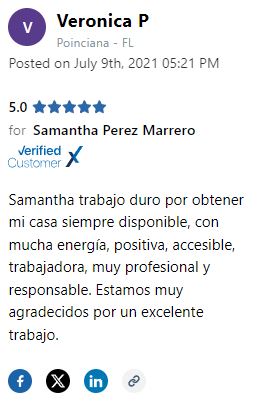

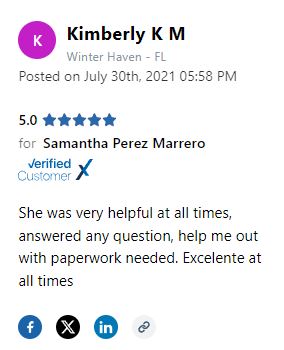

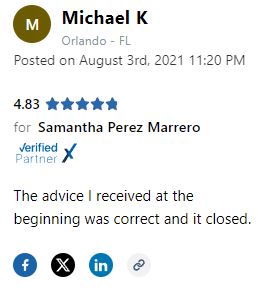

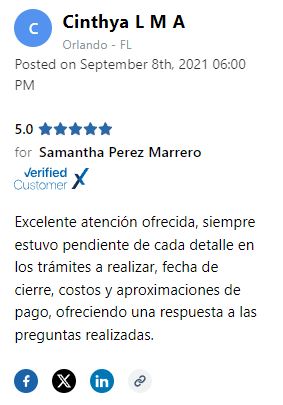

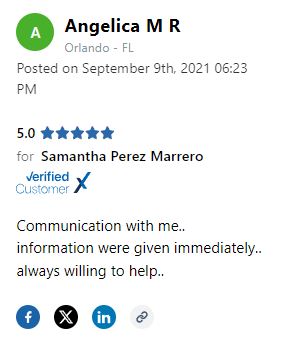

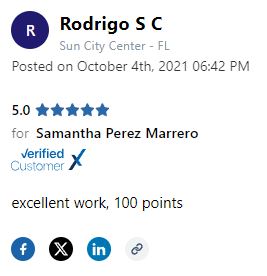

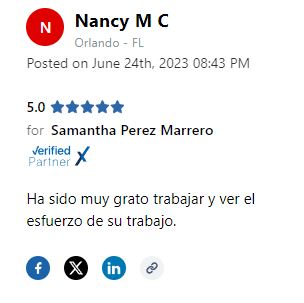

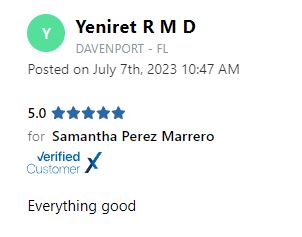

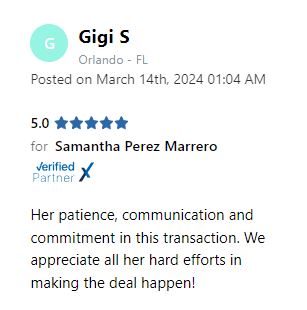

testimonial

what our client say ?

4.75 / 5 - from 55 review