Conventional Loans

Home > Conventional Loans

Explore flexible and competitive financing solutions with Samantha Home Loan Financing’s Conventional Loans. Whether you’re buying your first home or refinancing, our conventional loans offer a mix of simplicity and affordability that suits a wide range of borrowers.

benefit of our sevices

- Customizable Loan Options: Tailor your loan term, rate, and down payment to meet your financial goals.

- Lower Costs: Potentially lower fees and closing costs compared to government-backed loans.

- Flexible Terms: Choose from a variety of loan terms, including fixed and adjustable-rate mortgages.

- Less Stringent Approvals: Qualify with a wider range of credit scores and debt-to-income ratios than many government loan programs.

To enhance your approval prospects, ensure your business financials are in order, maintain a good credit score, clearly outline your business plan, and demonstrate a stable revenue stream. Consulting with a financial advisor can also provide valuable insights.

Business loans come in various forms, including term loans, lines of credit, and SBA loans. The choice depends on factors such as your business goals, the purpose of the loan, and your repayment capacity. Our financial experts can assist you in selecting the most suitable option.

Commonly requested documents include business financial statements, tax returns, a detailed business plan, personal financial information, and legal business documents. Having these prepared in advance can streamline the application process.

The approval timeline varies based on factors like the type of loan, the complexity of your application, and the lender's processing time. Generally, it can take anywhere from a few weeks to a few months. Once approved, funds are typically disbursed promptly, allowing you to initiate your planned business activities.

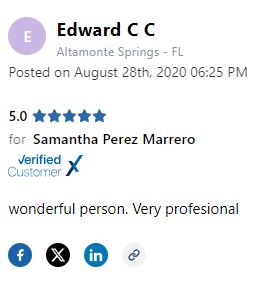

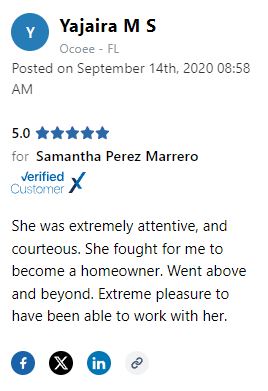

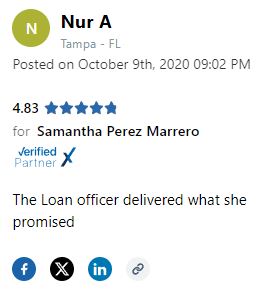

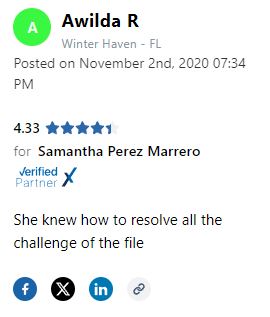

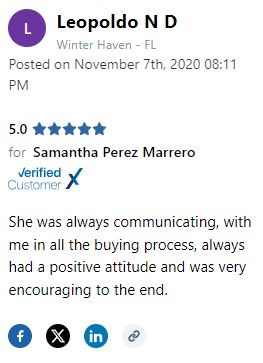

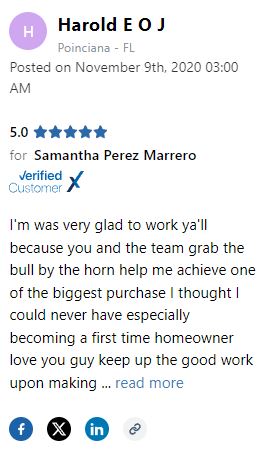

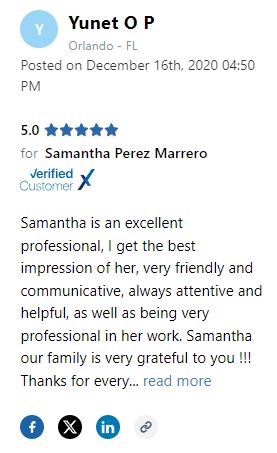

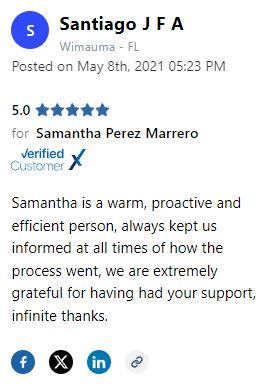

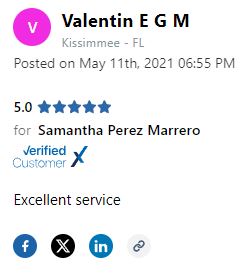

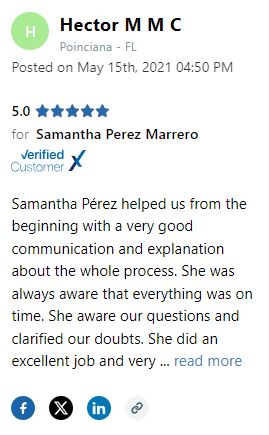

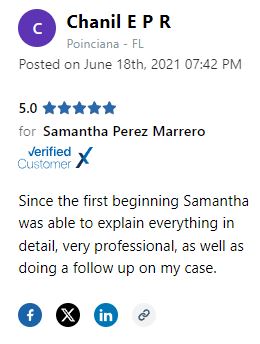

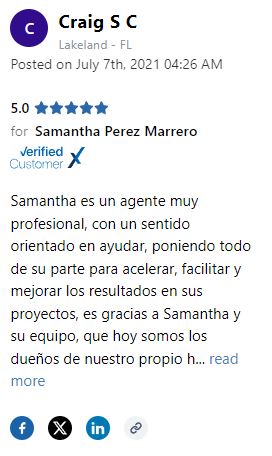

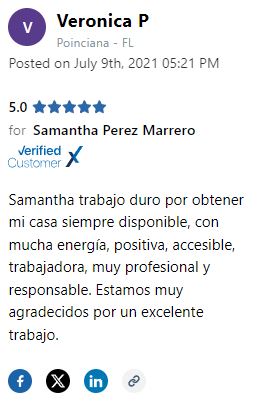

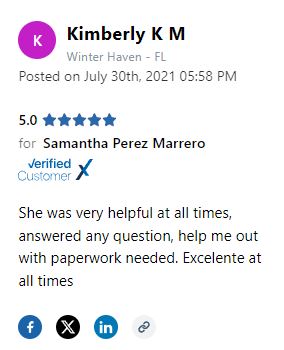

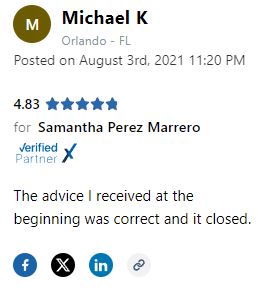

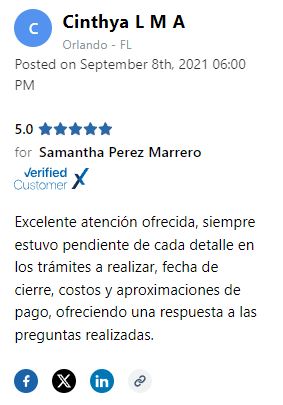

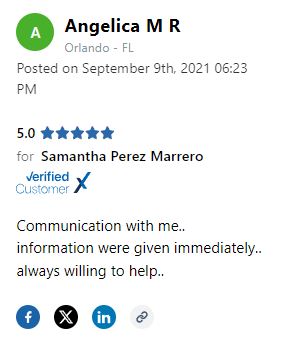

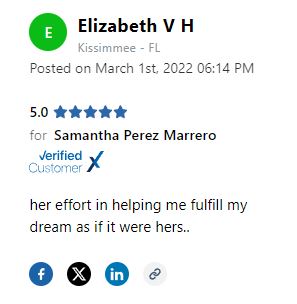

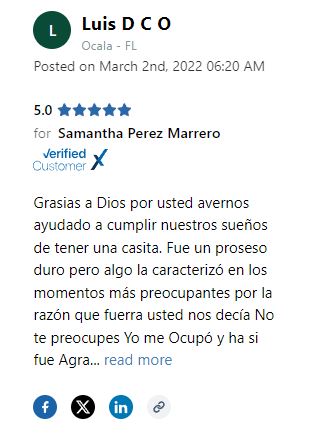

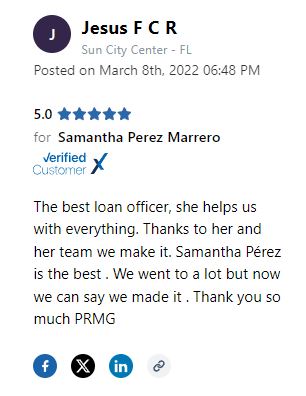

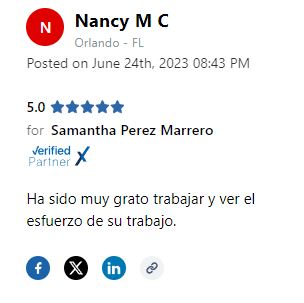

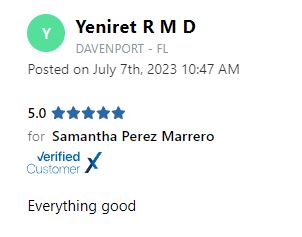

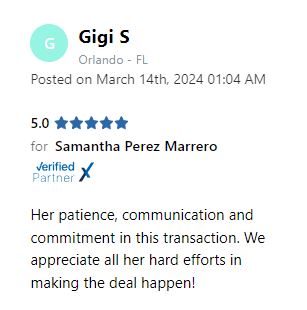

testimonial

what our client say ?

4.75 / 5 - from 55 review